Emirates NBD Egypt posts EGP 9bn in pre-tax profits in 2025

Font size

Emirates NBD – Egypt, one of the leading banks in the Egyptian banking sector, has reported strong financial results reflecting the success of its strategy focused on digital leadership, innovation, and providing integrated banking and investment solutions that meet evolving customer needs, while reinforcing its position as a trusted financial partner supporting growth and safeguarding wealth.

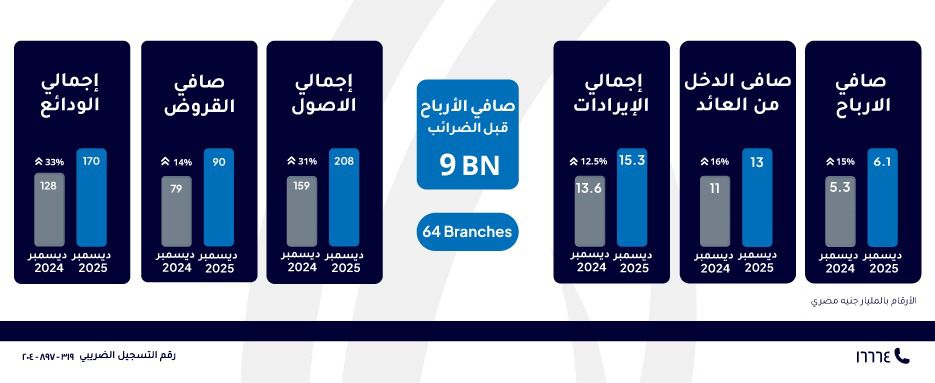

The bank recorded a Net Profit of EGP 6.1 billion by the end of December 2025, compared to EGP 5.3 billion at the end of December 2024, achieving a year-on-year growth rate of 15%. Total Revenues reached EGP 15.3 billion, up from EGP 13.6 billion in December 2024, representing a 12.5% annual growth.

On the balance sheet front, total assets reached EGP 208 billion at the end of December 2025 from EGP 159 billion at the end of December 2024, reflecting a growth rate of 31%. Shareholders’ equity increased to EGP 23 billion, up from EGP 17.4 billion in December 2024, achieving a 32% annual growth rate. The Return on Average Equity (ROAE) stood at 33%, while the Return on Average Assets (ROAA) reached 3.6%, and the Cost to Income Ratio was 30%.

On the lending side, total customer loans amounted to EGP 96 billion, up from EGP 84.1 billion at the end of December 2024, reflecting 14% growth rate. Corporate loans reached EGP 74 billion, up from EGP 67.2 billion in 2024, reflecting a 10% increase, while retail loans rose to EGP 22 billion from EGP 16.9 billion, marking a 29% growth compared to December 2024.

In terms of deposits, Total Deposits increased to EGP 170 billion at the end of December 2025 from EGP 128.2 billion at the end of December 2024, achieving a 33% growth. Corporate Deposits stood at EGP 100 billion, compared to EGP 82.1 billion in 2024, reflecting 22% year-on-year growth. Retail deposits reached EGP 70 billion versus EGP 46.1 billion last year, marking a 51% year-on-year increase, strengthening the bank’s funding base and diversifying its deposit portfolio.

Commenting on the results, Amr ElShafie, CEO & Managing Director of Emirates NBD – Egypt, said: “The financial results for 2025 reflect the success of the comprehensive strategy we launched in 2023, aimed at strengthening our financial position, improving operational efficiency, and expanding our customer base. These efforts translated into exceptional growth in key performance indicators, with net profit reaching EGP 6.1 billion, more than five times the baseline year, driven by a significant improvement in asset quality and a diversified loan portfolio.”

He added: “At Emirates NBD – Egypt, we continue to uphold the highest standards of corporate governance and risk management, while maintaining efficiency in capital and liquidity management. We remain committed to adopting best international banking practices and investing in the development of human capital.”

It is worth noting that Emirates NBD – Egypt, a leading financial institution under the Emirates NBD Group, began operations in the Egyptian market in June 2013. The bank offers a comprehensive range of banking services to individuals and corporates through a network of 64 branches nationwide, with a strategic focus on digital solutions and advanced banking experiences.